45+ should i refinance my mortgage rule of thumb

In this example the monthly payment at 5 is 2147. Web Term Length Rate.

:max_bytes(150000):strip_icc()/50-30-20budgetingrulecustomillustration-9973713c9be846c1b25b7bf372b4818d.png)

Rule Of Thumb When Should You Refinance Your Mortgage

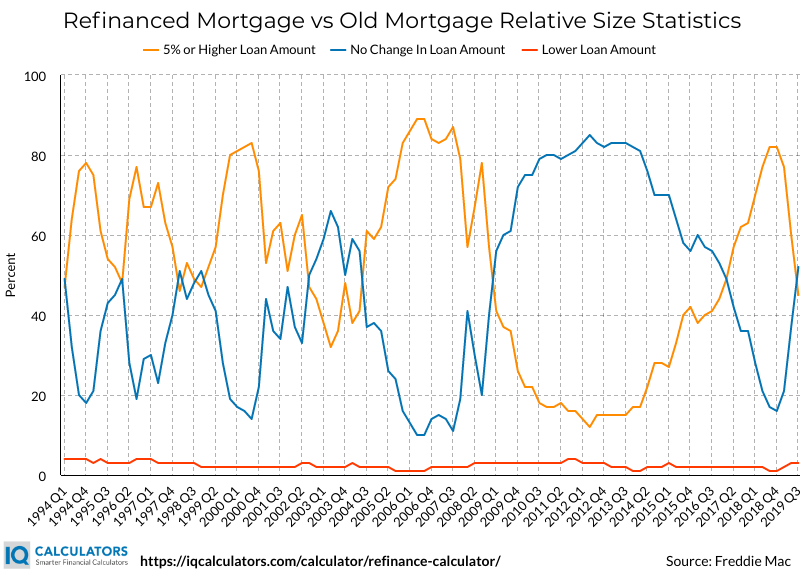

Web The average amount of a mortgage refinance was 364300 in the last week of February 2020 according to the Mortgage Bankers Association.

. The rates and terms banks offer change over time. Top Quality Refinance Home Loans Ranked By Customer Satisfaction and Expert Reviews. Put Your Equity To Work.

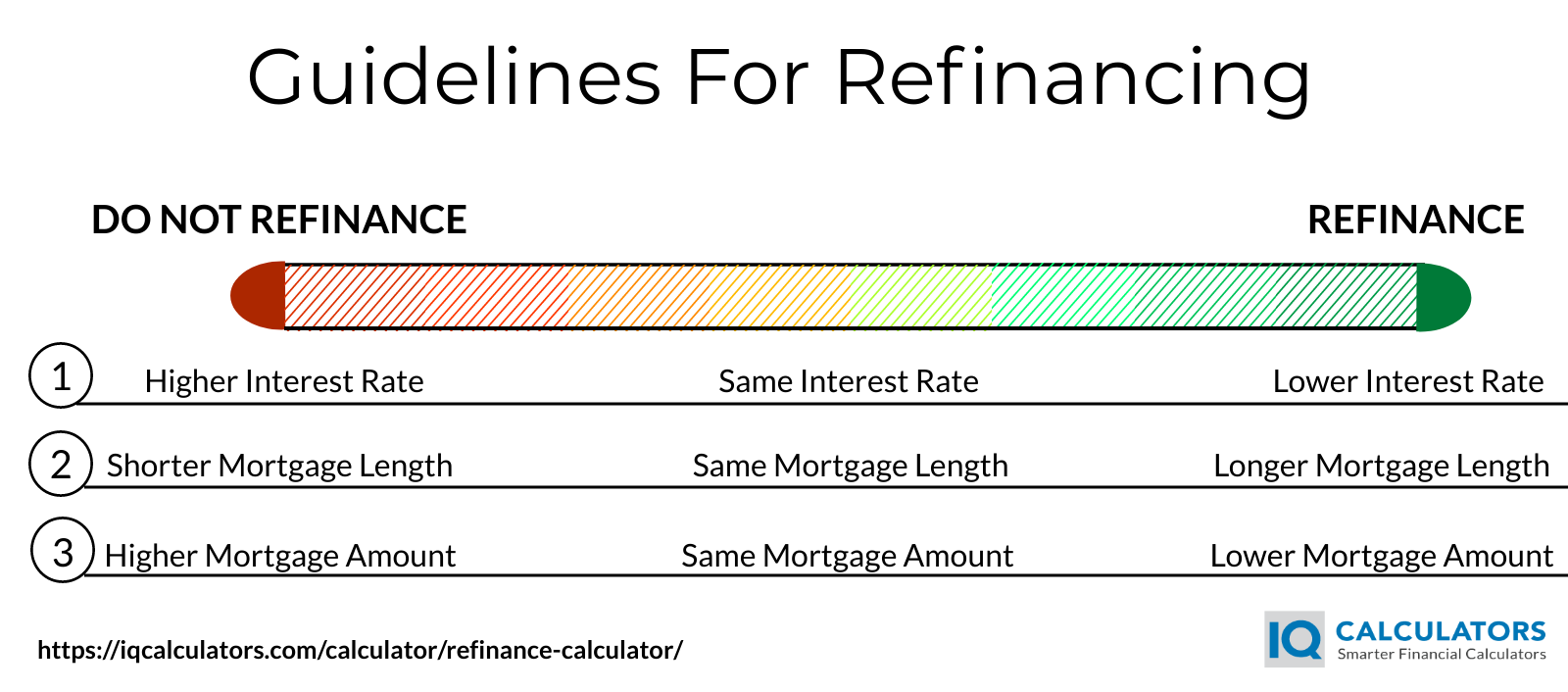

Web The typical should-I-refinance-my-mortgage rule of thumb is that if you can reduce your current interest rate by 1 or more it might make sense because of the. I mentioned the two-percent rule of thumb earlier. But there are plenty of other factors including closing.

Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Ad Compare Refinance Rates Lenders To Find The Perfect Mortgage For You. A Rule of Thumb Revised.

In truth there are several factors to consider when deciding when you should refinance your mortgage. Web Mortgage refinancing closing costs are about 2 to 5 of the total loan amount which includes the loan application fee appraisal fee and title search fee as. See Our 1 Top Pick.

Web With the 35 45 model your total monthly debt including your mortgage payment shouldnt be more than 35 of your pre-tax income or 45 more than your after-tax. Web After five years of on-time payments you owe 320000 on your mortgage. Ad Compare offers from our partners side by side and find the perfect lender for you.

Ad PNC Offers A Wide Range of Mortgage Options. Web As a rule of thumb refinancing your mortgage is worth it if the new rate is roughly 1 lower than your current rate. Web Heres a general rule-of-thumb that applies to most refi situations.

The 1 refinancing rule of thumb says that you should consider refinancingyour home when you can get an interest rate that is at least one percentage point lower than your current rate. Dont Wait For A Stimulus From Congress Refinance Instead. 30-year fixed-rate 5.

Web An often-quoted rule of thumb has said that if mortgage rates are lower than your current rate by 1 or more it might be a good idea to refinance. Make sure to factor in your current loan term when considering. Web This rule of thumb is far too general to be useful to you.

If you have a bad loan particularly if its fixed at a higher. Web Lets talk about a smarter way to determine when to refinance. Web Refinance closing costs and fees.

Web The traditional rule of thumb says to refinance if your rate is 1 to 2 below your current rate. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. This is the most commonly offered.

Web The best and most common reason for refinancing is to get a lower interest rate on your existing mortgage. Put Your Equity To Work. Ad Industry Experts Compare All Products Side By Side.

One rule of thumb is that refinancing can be worth it if theres a. Ad Learn How to Refinance Your House in a Few Simple Steps. Looking For a Loan Refinance.

Web Current rate on your mortgage vs. Dont Wait For A Stimulus From Congress Refinance Instead. Web The rule of thumb states that your monthly mortgage payment shouldnt exceed 1680 6000 x 28 and that your total monthly debt payments including.

In this scenario the homeowner wont start seeing savings until. If you refinance that 320000 into a 15-year FRM with an interest rate of 3 youll pay. Set A Budget Know What You Can Afford.

Refinance Today Save Money By Lowering Your Rates. If you have a 500000 loan amount the monthly savings with a 1 percentage point decrease in rat See more. On a loan of that amount the.

Your Loan Should Too. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. The lower the new rate the better.

Nerdwallet Reviewed Refinance Lenders To Help You Find The Right One For You. Web One rule of thumb is that refinancing can be worth it if theres a difference of at least one percentage point between your current mortgage rate and the new rate you. Serious About Finding Your Next Home.

If you can lower your interest rate and mortgage payments by refinancing and youll stay in the home long. Ad Start Your Refinance With Americas 1 Online Lender. Time to break even.

Check Out Our Rates Comparison Chart Before You Decide. Refinance Your Mortgage Into A Low Interest Rate. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi.

Web One rule of thumb is that refinancing can be worth it if theres a difference of at least one percentage point between your current mortgage rate and the new rate you. Start The Application Process Today.

The Ignorance Of People 40 Today You Can T Even Have A Conversation Without Them Gaslighting You Into Thinking The Market Is Affordable For Young People R Canadahousing

What Would You Choose Between Renting And Buying Quora

Requirements To Refinance Your Mortgage Nerdwallet

Rule Of Thumb For Mortgage Refinancing Spirit Financial Cu

How Much Income Do You Need To Refinance Your Mortgage Marketwatch

Which Type Of Mortgage Is Best For Me Quora

Derwent Finance Best Mortgage Broker Hobart Tasmania

:max_bytes(150000):strip_icc()/RulesofThumb-ArticlePrimary-1a49faa8c635412db26a844b57ee2009.jpg)

Rule Of Thumb When Should You Refinance Your Mortgage

:max_bytes(150000):strip_icc()/avoiding-bad-home-layout-1798346_final-92e4aab4fe7d4913ac1493d24fc8267f.png)

What Is The 28 36 Rule Of Thumb For Mortgages

Derwent Finance Best Mortgage Broker Hobart Tasmania

6 Essential Factors To Consider When Refinancing A Mortgage

Flipping Junkie Podcast With Danny Johnson Podcast Addict

Why Would Paying Off Bank Loans Contract The Money Supply Quora

List Of Top Home Loan Providers In Mahanagar Best Housing Loans Online Justdial

Mortgage Broker Brisbane

The Refinance Rule Of Thumb Only Refinance Your Mortgage If

The Refinance Rule Of Thumb Only Refinance Your Mortgage If